The Smart Benefit by Yf Plans

Mar 28, 2023

Employee Strategies for Better Financial Outcomes

Employee Benefits

Managing debt is challenging, especially when multiple sources of debt have different interest rates and payment schedules. TSB is the smart solution for employees struggling with high-interest debt and student loan payments.

Trending

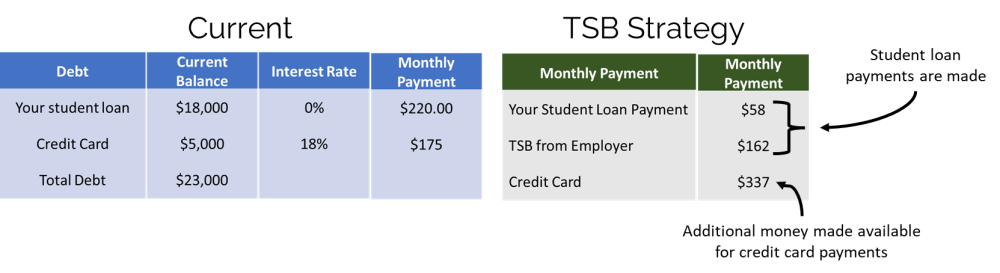

Employees use a portion of employer contributions (from the retirement plan) to make their monthly student loan payment and free up money to pay down more expensive debt, like credit cards. This strategy can help avoid some high credit card interest and gets employees back on track with savings and investing goals.

By allocating a portion of your employer's savings plan contributions to pay some, most, or all of your monthly student loan payment, you then lower the amount of your own monthly student loan payment and use employer contributions to make up the difference, By reducing the burden of student loan payments and freeing up money to pay down other debt or expenses, TSB improves monthly affordability and can reduce financial stress.

When employers offer TSB financial wellness plans, they are providing valuable support and meaningful options for employees struggling with high-interest debt and student loan payments. It's important to note that everyone's financial situation looks different, and speaking with a financial planner can be helpful to determine the best course of action for your specific circumstances.